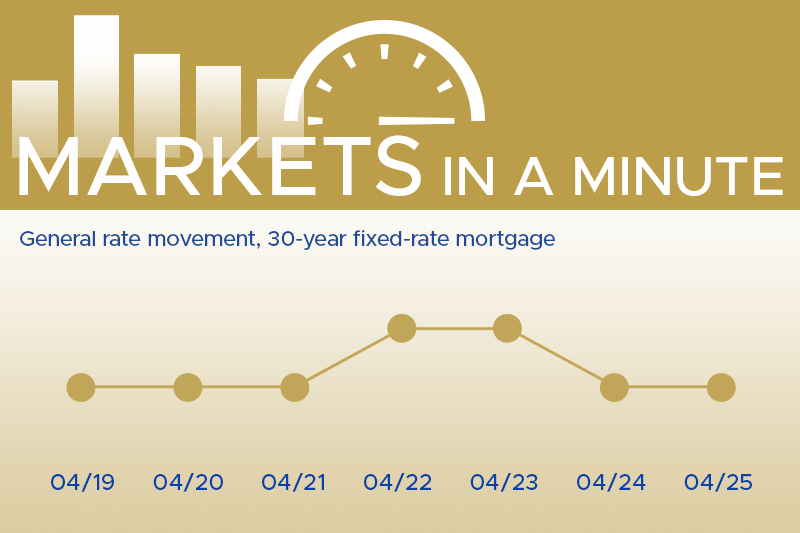

Welcome to our weekly roundup, where we bring you the latest housing market and economic…

Financial Preparation for Homeownership In 7 Key Steps

Buying a home is likely the biggest financial decision most people will make in their lives. Financial preparation for homeownership before taking that major step is crucial to ensuring that you realize your dream. Here are 7 key steps to prepare your finances for homeownership.

Step 1. Check your credit report

Your credit history and credit score will be a major factor in getting approved for a mortgage and determining the interest rate you qualify for. Check your credit reports from the three major bureaus (Experian, Equifax, TransUnion) and dispute any errors. Work on improving your credit score if needed by paying down debts, making payments on time, and limiting new credit applications.

Step 2. Determine your homebuying budget

Take a close look at your monthly income and expenses to figure out how much you can comfortably afford to spend on a monthly mortgage payment, including taxes and insurance. Most lenders recommend your housing costs (mortgage, property taxes, insurance, HOA fees) should not exceed 28% of your gross monthly income. Use online calculators to crunch the numbers.

Step 3. Save for a down payment

The more you can put down on a home, the better. Lenders generally require a minimum 20% down payment to avoid private mortgage insurance (PMI), but some loan programs allow as little as 3-5% down. Aim to save as large a down payment as possible to keep your monthly costs lower.

Step 4. Build an emergency fund

Having 3-6 months’ worth of living expenses set aside in savings is recommended before buying a home. This emergency fund can help cover unexpected repairs, job loss, or other financial shocks.

Step 5. Pay down debt

High levels of existing debt, such as credit cards, student loans, or auto loans, can make it harder to qualify for a mortgage and keep your monthly payments affordable. Work on paying down debts, especially high-interest ones, before applying for a home loan.

Step 6. Research mortgage options

Familiarize yourself with the different types of mortgage loans available, such as conventional, FHA, VA, and USDA loans, as well as the pros and cons of each. This will help you determine which loan program best fits your financial situation.

Step 7. Get pre-approved for a mortgage

Before you start house hunting, get pre-approved by your Thompson Kane loan officer. This shows sellers you are a serious, qualified buyer and can give you an advantage in a competitive market. The pre-approval process involves submitting financial documentation so the lender can assess how much they are willing to lend you.