Here's our latest installment of industry insights and relevant economic news. This Week's Economic News…

Navigating Seasonal Trends: Understanding the Impact of Mortgage Rates

In the world of real estate and finance, understanding the ebbs and flows of mortgage rates is crucial for potential homebuyers. From fluctuating economic conditions to seasonal trends, various factors influence these rates, ultimately shaping the affordability of homeownership. At Thompson Kane & Company, we recognize the importance of empowering borrowers with knowledge about these common trends and guiding them through the complexities of securing the right mortgage. Let’s delve into how seasonal fluctuations impact mortgage rates and how we can assist you in navigating this terrain.

Seasonal Trends and Understanding Mortgage Rates

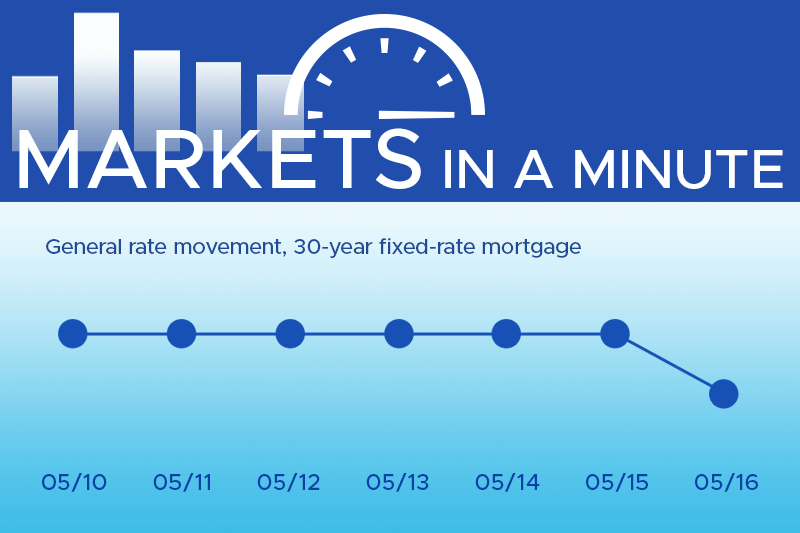

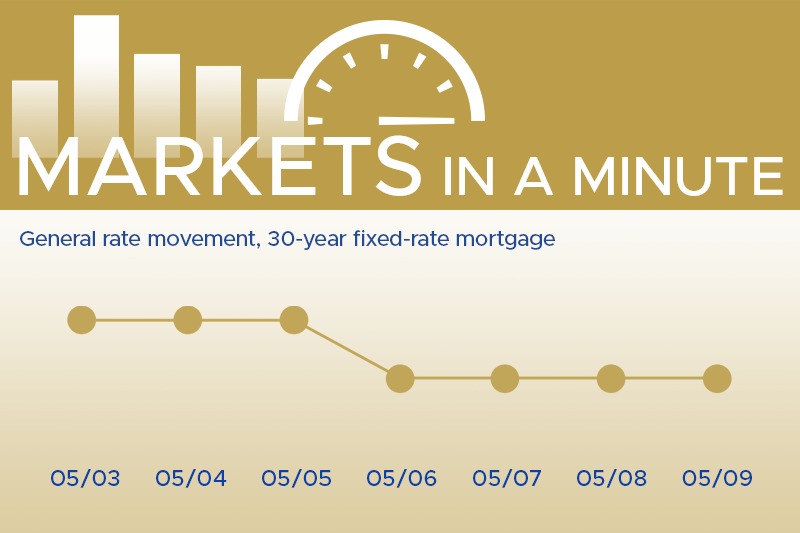

It’s a well-known phenomenon that mortgage rates tend to follow a seasonal pattern. Historically, rates have often dipped during the winter months, coinciding with a slower housing market. Conversely, as the spring and summer seasons approach, rates typically rise in response to increased buyer demand and a more active real estate market.

This cyclical behavior is driven by various factors, including consumer confidence, economic indicators, and the overall supply and demand dynamics of the housing market. During the colder months, when home sales tend to slow down, lenders may offer more attractive rates to entice borrowers. Conversely, as the warmer seasons bring an influx of buyers, lenders may adjust rates upward to manage the increased demand.

Understanding Mortgage Rate Fluctuations

While seasonal trends can provide a general guideline, it’s essential to recognize that mortgage rates are influenced by a complex interplay of factors beyond just seasonality. Economic indicators, such as inflation, employment data, and Federal Reserve policies, can significantly impact rate movements. Additionally, global events, geopolitical tensions, and market volatility can contribute to rate fluctuations.

At Thompson Kane, our team of experienced mortgage professionals stays abreast of these intricate dynamics, closely monitoring market trends and economic indicators. We understand that timing can play a crucial role in securing favorable mortgage rates, and our expertise can help you navigate these fluctuations effectively.

Personalized Guidance for Your Home Financing Needs

Whether you’re a first-time homebuyer, looking to refinance, or seeking investment property financing, our team is committed to providing personalized guidance tailored to your unique circumstances. We take the time to understand your financial goals, risk tolerance, and long-term plans, ensuring that our recommendations align with your best interests.

By leveraging our knowledge of seasonal mortgage rate trends and our deep understanding of the broader economic landscape, we can help you make informed decisions about when to lock in your rate or explore alternative financing options. Our commitment to transparency and open communication ensures that you remain well-informed throughout the entire process.

At Thompson Kane & Company, we believe that homeownership should be an empowering and rewarding experience. By partnering with us, you’ll have a trusted ally by your side, ready to assist you with any questions or concerns you may have regarding mortgage rates, seasonal trends, or any aspect of your home financing journey.