Welcome to our weekly roundup, where we bring you the latest housing market and economic…

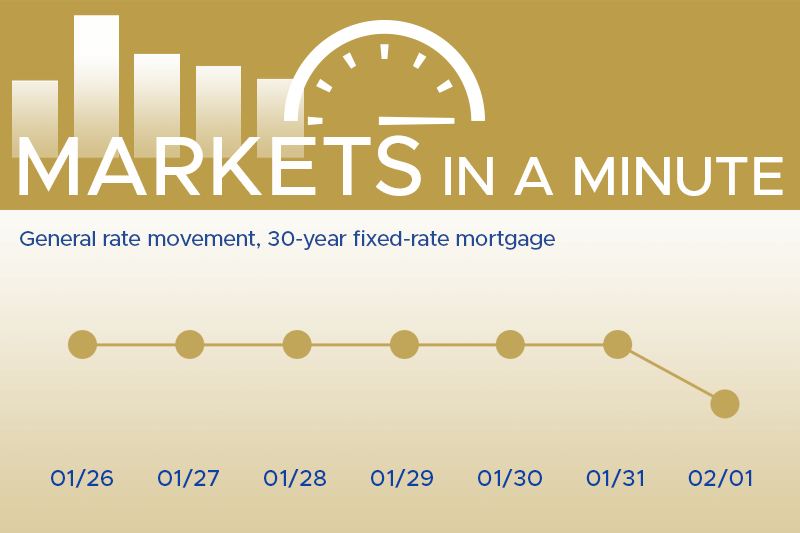

Markets in a Minute, Housing Market News, February 02, 2024

This week’s financial and housing market activity update…”

The Economy

- The latest figures on consumer confidence paint an optimistic picture, reaching the highest point since December 2021 and showing a remarkable increase of over 30% from the low point observed in April 2020.

- December witnessed job openings hitting a three-month peak, underscoring the robustness of the labor market as demand for skilled workers persists.

- In its recent FOMC meeting, the Federal Reserve chose to keep policy rates steady. However, a noteworthy shift was signaled, expressing a readiness to adjust rates if data confirms a moderation in inflation.

Housing Market Updates

- A recent study conducted by Harvard indicates a welcome relief for renters, as costs have tapered off from previous record highs. The current trajectory shows a moderate annual rise near 1%.

- The FHFA’s House Price Index brings encouraging news for the real estate market, reporting a growth rate of 0.3% for November on a seasonally adjusted basis. Year over year, there is a substantial increase of 6.6%.

- While total mortgage application volume experienced a dip of 7.2% for the week, it’s important to note the nuanced changes within this figure. Purchase applications saw an 11% decrease, whereas refinance applications witnessed a modest uptick of 2%.