Welcome to our weekly roundup, where we bring you the latest housing market and economic…

Housing Market News for March 15th, 2024

Welcome to our weekly roundup, where we bring you the latest housing market news and meaningful financial developments.

The Economy

- February saw wholesale prices surge beyond expectations, underscoring the persistent challenge of inflation in our economy.

- Consumer inflation followed suit, prompting the Federal Reserve to maintain a cautious stance on potential rate adjustments, likely delaying any moves until at least summer.

- While retail sales showed a promising uptick last month, consumer spending faced headwinds from inflationary pressures and rising borrowing costs.

Housing Market News

- In a recent announcement from the FHFA, a new pilot program offers homeowners the opportunity to refinance without the burden of title insurance fees, potentially providing relief for those looking to lower their mortgage expenses.

- Highlighting the impact of interest rates on buyer behavior, purchase mortgage applications saw a 5% increase last week, albeit still trailing behind figures from a year ago.

- Interestingly, a recent survey revealed that over a third of homeowners envision staying in their current residences indefinitely. This sentiment was particularly pronounced among younger respondents, hinting at shifting attitudes towards homeownership and mobility.

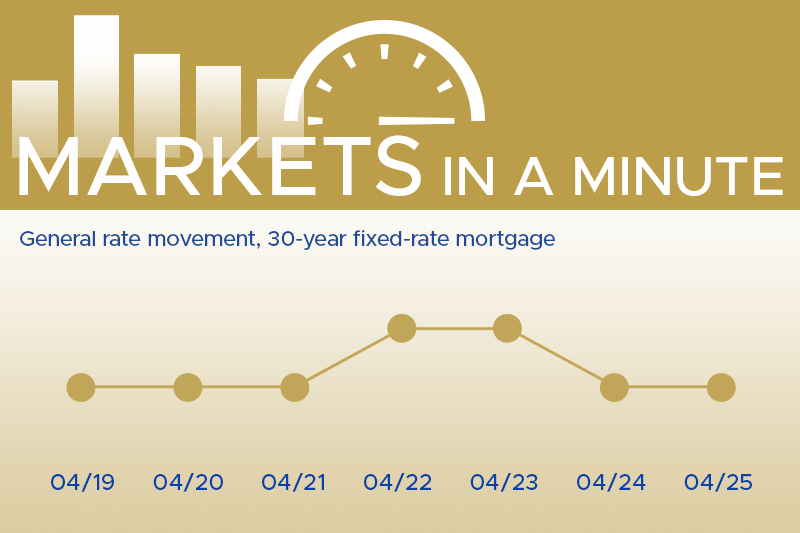

These recent developments underscore the ever-evolving landscape of the housing sector, emphasizing the necessity for continual awareness among potential homebuyers and stakeholders in the industry. This encompasses a wide array of professionals, ranging from real estate agents, financial institutions like Thompson Kane, and developers to builders and contractors. Be sure to stay tuned for our next update on February 22nd, as we delve deeper into the latest insights in our Markets in a Minute series!