Welcome to our weekly roundup, where we bring you the latest housing market and economic…

Housing Market and Economic News for March 22nd, 2024

Welcome to our weekly roundup, where we bring you the latest housing market and economic news.

The Economy

- In the latest economic news, the Federal Reserve opted to maintain policy rates during this week’s gathering, reinforcing its earlier projection of three potential rate adjustments in 2024.

- Surprising news on the employment front as unemployment claims took an unexpected dip last week, signaling robust job creation throughout March.

- Encouraging signs persisted in both manufacturing and service sectors, as indicated by the S&P Global Manufacturing and Services reports, reflecting sustained growth rates in early March.

Housing Market News

- February brought a notable surge in home sales, marking a substantial 9.5% increase, the most significant monthly upswing in a year, supported by a healthier supply of available homes.

- The median home price followed suit, rising by 5.7% to reach $384,500. Boosting optimism further, March witnessed a rise in homebuilder confidence, hitting levels not seen since July, driven by favorable mortgage rates and persistently limited inventory.

- Construction of single-family homes soared in February, reaching its highest point in nearly two years. Moreover, building permits climbed to a 1½-year peak, indicating sustained momentum in the housing market.

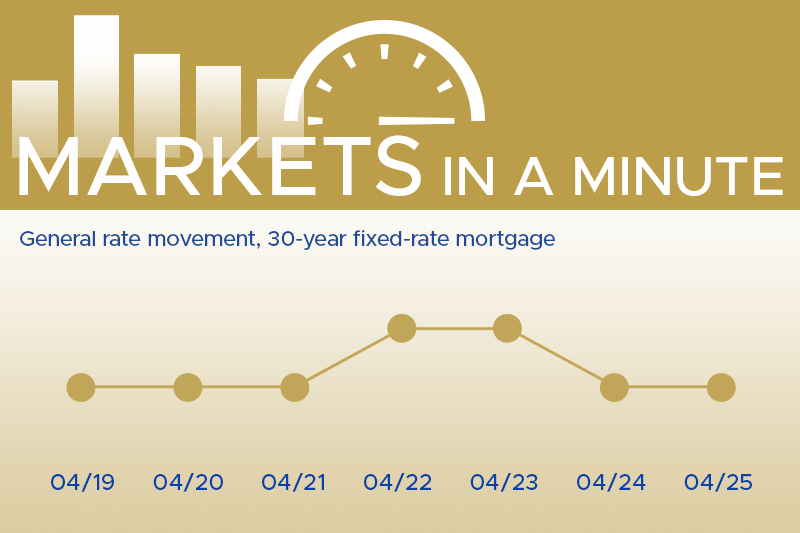

These developments exemplify the dynamic nature of the housing market, and express the value of staying informed for both aspiring homeowners and industry players. This includes a diverse range of experts, from real estate agents to financial institutions like Thompson Kane, as well as developers, builders, and contractors. Keep an eye out for our upcoming update on March 29, where we’ll dive into the freshest insights as part of our Markets in a Minute series!