Welcome to our weekly roundup, where we bring you the latest housing market and economic…

Markets in a Minute, Housing Market News, December 20, 2023

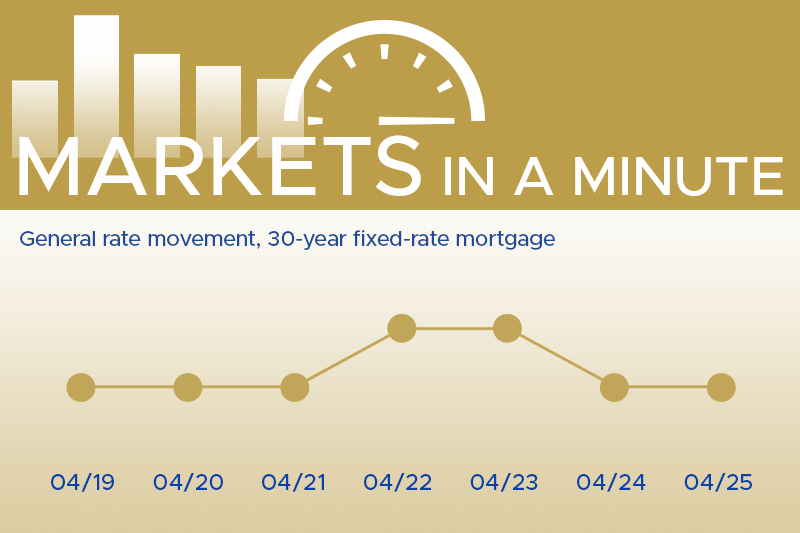

This week’s financial and housing market activity update…”

The Economy

- The Federal Reserve has indicated a halt in its policy rate hikes and the possibility of at least three cuts in 2024, a move expected to positively impact mortgage rates.

- In November, inflation moderated to a 3.1% annual rate, aligning with projections and supporting the conclusion of Fed rate adjustments.

- Additionally, November witnessed an unexpected surge in retail sales, coupled with jobless claims reaching historic lows, indicating the resilience of the economy and a robust labor market.

Housing Market Updates

- With the decline in mortgage rates, refinance applications experienced a notable 19% surge for the week, marking a substantial 27% increase from the previous year.

- Meanwhile, purchase applications saw a 4% weekly uptick, though they remained 18% lower compared to the same period last year.

- The housing market continues to grapple with limited inventory, exerting pressure on sales.

- In October, home prices, as reported by ICE Mortgage Technology, reached another peak, with unadjusted annual growth escalating to 4.6%, up from 4.2% in September. These dynamics reflect the ongoing challenges and opportunities within the real estate landscape.

Wishing You Joy and Warmth this Holiday Season!

As the year draws to a close, we want to express our heartfelt gratitude to each of our valued customers. We extend our warmest wishes for a happy and peaceful holiday season. May your holidays be filled with joy, love, and cherished moments. Thank you for choosing Thompson Kane as your mortgage partner. Here’s to a wonderful holiday and a bright and prosperous New Year!