Welcome to our weekly roundup, where we bring you the latest housing market and economic…

Markets in a Minute, Housing Market News August 7, 2023

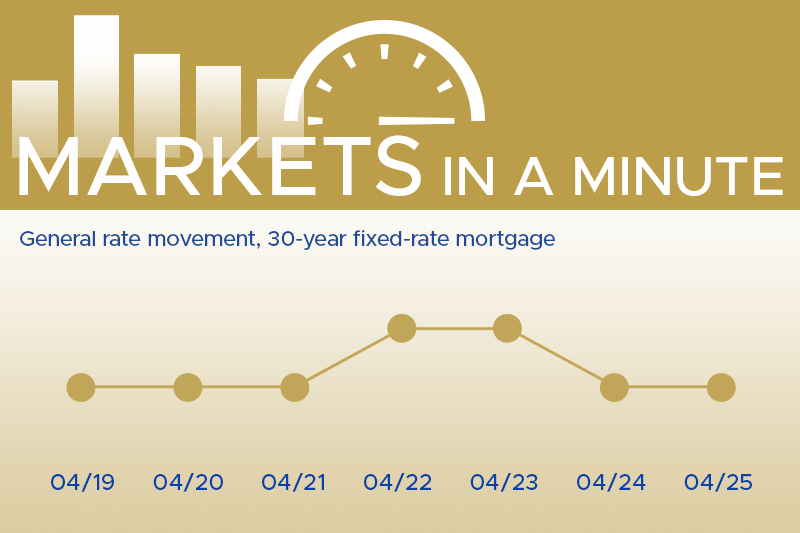

This week’s financial and housing market activity update…

The Economy

- ADP’s latest report showed a substantial increase of 324,000 jobs within the private sector in July. This figure exceeded expectations, providing an indication of a robust labor market. This surge doesn’t only hold promise for the immediate future. It also indicates the underlying strength and potential inherent in the job market. At the same time, July witnessed a small uptick in the Purchasing Managers’ Index (PMI), a key measure of where the manufacturing sector is heading. The U.S. PMI ticked up from 46.0 in June to 46.4 for July. This was the 8th straight month of contraction in the sector (July ‘22 PMI was 52.8), but it shows a softening in the downward trend.

- Labor Market Insights

187,000 jobs were added in the U.S. in July, significantly lower than the 312,000 monthly average over the past year (more at BLS.gov). May and June’s high employment numbers were revised down by 49,000 jobs as well. Lower July job growth was offset by a minor decrease in layoffs, an unemployment rate slightly lower than June’s 3.6%, and a 0.4% average hourly earnings increase. Taken as a whole these numbers suggest that the economy is remaining resilient against the Fed’s inflation-busting tightening measures.

Housing Market News

- Housing Trends: Construction Gains and Global Buyers. June saw a notable 3.5% year-over-year upswing in construction spending, while May data was revised up as well. This growth was fueled by investments in both single-family and multifamily housing projects. The surge continues to be driven by the lack of existing homes available in the market. Foreign buyers bought 14% fewer U.S. homes in the past year which corresponds logically to a record-high median home price of $396,400.

- Affordability Insights: Homeownership Aspirations

Elevated mortgage interest rates continue to challenge affordability and take a toll on the housing market. New listings of starter homes are down 23% from last year as existing homeowners await better rates. Redfin reports that higher home prices and mortgage rates have driven the income needed to purchase a typical starter home in the U.S. up 13% compared to last year. To comfortably afford the typical starter home (priced at $243,000 in June), a first-time homebuyer would need an annual income of $64,500. This data sheds light on the financial benchmarks necessary for embarking on the journey of homeownership today. In conclusion, the economic and housing landscapes are a blend of trends and shifts that shape our financial world. Thompson Kane stays in tune with these intricacies to maintain a solid grasp of the evolving economic reality. This kind of deeper market knowledge helps us give each of our valued customers the best service possible.