Welcome to our weekly roundup, where we bring you the latest housing market and economic…

Understanding Mortgage Rate Trends: Predictions for 2024

Continuing into 2024, those considering buying or refinancing a home will be paying a lot of attention to mortgage rate trends. This fixation is understandable, given the direct influence interest rates have on monthly payments and the overall cost of owning a home. In this post we investigate today’s mortgage landscape, providing insights into the prevailing conditions and offering educated predictions of what may unfold over the course of the year.

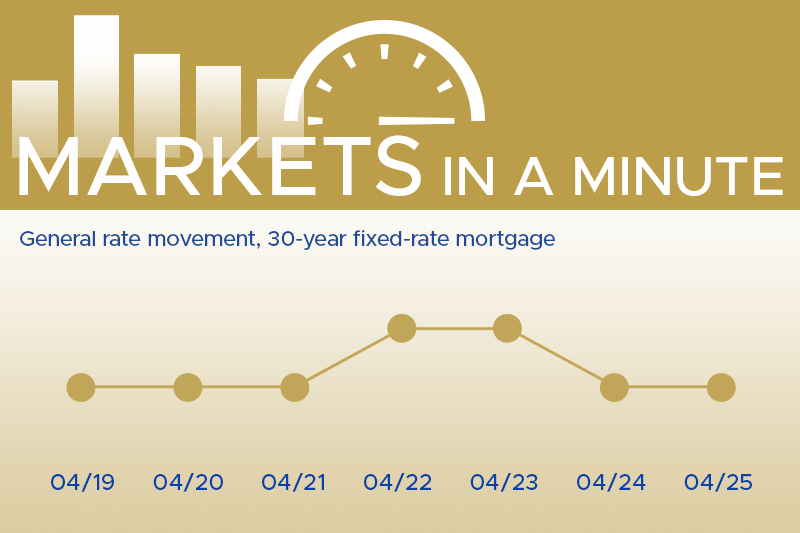

Today’s Mortgage Rate Trends

This year so far we’re seeing many influences on mortgage rates. Inflation, domestic money policy, and global economic uncertainties all influence the landscape. Despite last year’s ups and downs, economists cautiously anticipate stability on the horizon.

What to Expect in 2024

Experts anticipate a more stable trajectory for mortgage rates in 2024, with the likelihood of moderate fluctuations throughout the year. The Federal Reserve’s efforts to control inflation without triggering a recession are significant in this context. If these measures are successful, we may not see the sharp spikes that began in 2022 and carried through 2023..

Major Influences on Mortgage Rate Trends

Each of the following primary influences on mortgage rates influences the others. When new developments break in one of these key areas, we can expect the others to be affected:

- Our Economy: Signs of a robust economy, such as low unemployment, increased inflation, a bump in new home construction, and an optimistic consumer confidence index, could push rates up. The opposite of these, e.g. a slowing economy, high unemployment, and so on, typically prompt decreases. Where to look for reputable economic news.

- Inflation: Changes in bank interest rates mandated by the Federal Reserve to combat inflation, and/or stave off a recession, may continue to influence fluctuations in mortgage rates.

- Housing Market Dynamics: Supply and demand in the housing market will also impact rates. An increase in home inventory could stabilize rates, while a shortage might apply upward pressure.

Essential Actions for Homebuyers and Homeowners

- Keep Informed: Stay updated on economic news and understand how broader economic trends can influence mortgage rates.

- Lock in Mortgage Rates: If you’re in the process of buying a home or refinancing and rates dip, you can talk with your Thompson Kane mortgage lender about securing the rate to safeguard against potential future increases.

- Consult the Experts: Your Thompson Kane mortgage team can provide personalized advice based on your financial situation and goals.

Conclusion

Accurately forecasting mortgage rates is a complex task, but staying well-informed about economic indicators and trends equips you to make informed decisions. Whether you’re preparing to buy a home or refinance in 2024, a keen understanding of the factors influencing mortgage rates can help you along your financial journey. Remember, the landscape may have its uncertainties, but arming yourself with knowledge and professional advice will help you to confidently tread the path toward your housing goals.