Our latest installment of industry insights and relevant economic news, designed to keep you informed…

Markets in a Minute, Housing Market News, December 1, 2023

This week’s financial and housing market activity update…

The Economy

- Inflation Holds Steady at 3.5%: The Federal Reserve’s key measure of inflation, gauged through personal spending, demonstrated a year-over-year increase of 3.5% in October, aligning with market expectations.

- Mixed Signals in Consumer Confidence: While consumer confidence rebounded in November after three consecutive monthly declines, a significant two-thirds of consumers express concerns, anticipating a potential recession in 2024.

- Fed’s Report Reveals Economic Slowdown: Recent data released by the Federal Reserve indicates a slowdown in economic activity, attributed to a pullback in discretionary spending by consumers.

Housing Industry Updates

- New Home Sales Dip Below Projections: New home sales experienced a downturn last month, falling below analysts’ expectations, largely attributed to mortgage rates hitting a peak for 2023.

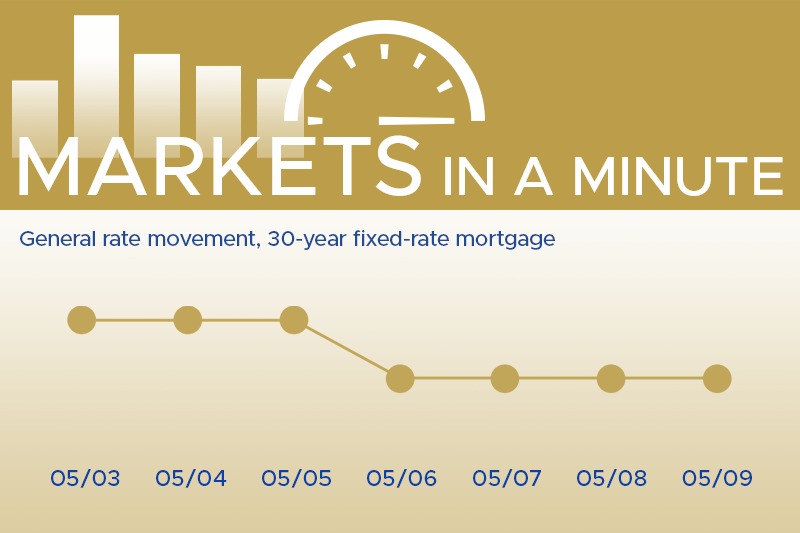

- Record Low for Pending Home Sales: A pending home sales index for October, compiled by the National Association of Realtors, shows sales reached their lowest levels in history (excluding the initial months of the COVID crisis when economic activities came to a virtual standstill). Pending home sales, indicating contracts in progress, are a meaningful indicator of the state of the U.S. housing market. The data from October suggests that real home sales, already hovering around record lows, are likely to remain sluggish in the coming months. On the bright side, the significant decline in the 30-year fixed mortgage rate in November may attract additional buyers to reenter the market. [axios].

- Mortgage Rates Ebb Down, Applications Rise: In a positive turn, mortgage rates have decreased since October’s peak, reflecting in a 5% increase in purchase mortgage applications for the week.

Looking at the Year Ahead

There is light at the end of the tunnel for the housing industry. Inflation is showing signs of cooling with lower than expected increases recently. This may relieve upward pressure on prices. Additionally, the Fed’s interest rate hiking campaign, while not officially over, has paused for assessment. This breather has already allowed mortgage rates to ease from their peak highs over the past couple months. With this relief on inflation and rates, housing affordability may start slowly improving from extremely tough conditions all year for both homebuyers and those of us in the industries that serve homebuyers.

Now is the time for industry professionals to reconnect with past clients, promote housing services and get purchase-ready, and strategize for unique value offerings. The market will eventually stabilize and turn around. Patience and preparation now will pay dividends down the road. There are still buyers and sellers out there. With the right targeted outreach and messaging emphasizing affordability improvements, professionals can motivate action on the housing front as we close out 2022. Stay optimistic and vigilant for positive changes in 2023!