Our latest installment of industry insights and relevant economic news, designed to keep you informed…

Housing Market News, August 29, 2023

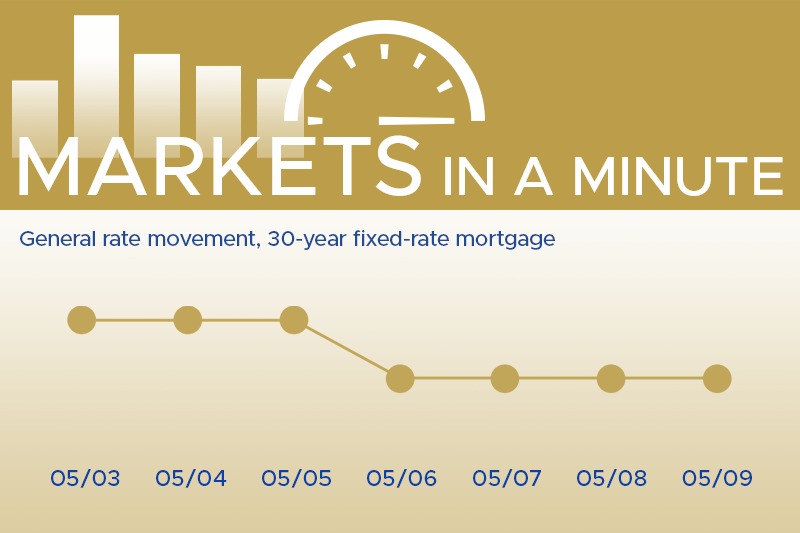

This week’s financial and housing market activity update…

The Economy

- In August, the sentiment among Americans regarding the economy showed increased pessimism due to inflation concerns.

- Notably, the number of job openings experienced a significant decline, reaching its lowest point in almost two and a half years [Reuters]. Similarly, the rate of resignations saw a decrease in July, signaling a gradual deceleration in the momentum of the labor market. This news supports a sentiment that the Fed is less likely to move interest rates in September.

- During this period, the Federal Reserve’s preferred gauge of inflation displayed the most modest consecutive increases in July since the latter part of 2020. This trend further underscored the ongoing cooling of inflationary pressures, suggesting a moderated economic landscape.

Housing Market News

- Continuing a promising trend, pending home sales demonstrated resilience with a second consecutive monthly increase in July [NAR.Realtor]. This notable rise occurred despite elevated prices, a surge in mortgage rates, and the ongoing challenge of remarkably constrained inventory.

- In the month of June, the housing landscape showed further signs of stabilizing [Reuters]. Two reports highlighted this trend, hinting that sales prices might have reached a bottom point, potentially paving the way for more balanced market condition. Home sale prices increased by 2.9% year over year in May and by 3.1% in June. This came after more than 14 consecutive months of declines, according to Federal Housing Finance Agency (FHFA) data.

- Despite interest rates lingering at recent highs, there was an increase in mortgage applications. The figures revealed a 2.3% increase from the previous week, marking the first such surge in five weeks.